What is ADR? with types, definition, operation, advantages and disadvantages

We explain that what is ADR? with types, definition, operation, advantages and disadvantages. Certificates of Deposit are an essential mechanism for obtaining capital for national companies in the international securities markets. They are mainly trading instruments through which foreign investors buy shares of national companies registered in local markets using local currency. types of adr

We explain that what is ADR? with types, definition, operation, advantages and disadvantages. Certificates of Deposit are an essential mechanism for obtaining capital for national companies in the international securities markets. They are mainly trading instruments through which foreign investors buy shares of national companies registered in local markets using local currency. types of adr

In exchange for this investment, they issue a right denominated in convertible currency; mainly US dollars. These claims are called depository receipts and are recorded on the stock exchange.

There are mainly two types of certificates of deposit that are listed on the national stock exchange, but they denote the security problems of a foreign company listed on the stock market. American deposit slip is one of them.

How does American Depository Receipt work? types of adr

An ADR or American Depository Receipt is a negotiable instrument or certificate issued by a US depositary bank to denote the securities of a foreign company listed on the US stock market. These are denominated in US dollars and are traded on the US equity markets just like domestic stocks.

Foreign companies must provide all critical information about their financial status for a US bank to convert their shares into ADRs. types of adr

The bank then buys those shares in foreign currency and holds them as inventory to issue ADRs for trading in domestic markets.

A company’s illustrious description of its financial health allows US investors to decide whether or not they want to invest in that company.

ADRs serve as a lucrative opportunity for US investors who want to hold shares in foreign markets, which would not otherwise be accessible.

It also proves profitable for foreign companies, as they can attract capital from US investors without suffering the expense and hassle of listing on the US equity markets.

Some of the major US stock exchanges where ADRs are listed include the New York Stock Exchange and the Nasdaq. However, they are also traded over the counter (OTC).

Types of United States Depository Receipts types of adr

There are mainly two types of ADRs that are traded on the US stock exchanges: types of adr

- Sponsored: These are the results of an agreement between a US bank and a foreign company. According to the agreement, the ADR issuance expense will be borne by the company. Rather, the bank will deal with transactions with stakeholders.

- Not sponsored: They are issued by US banks without the participation or even permission of the foreign company. Unlike sponsored ADRs, these are only traded without a prescription. On top of that, investors have no voting rights in the case of sponsored ADRs.

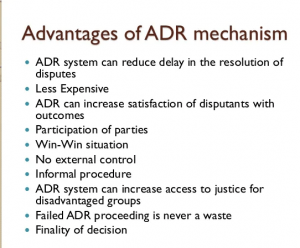

Advantages of the US Depository Receipt

The following are some of the important advantages of a US Certificate of Deposit: types of adr

- As they are issued in local currency, both investors and companies find them without problems to trade . For investors, they are a unique opportunity to own shares in foreign companies. For companies, on the other hand, they are an easier way to attract American investors. types of adr

- US banks issue ADRs with the underlying security held as inventory. Consequently, they are easy to track .

- ADRs are denominated in US dollars . Consequently, they can be easily traded on national markets.

- ADRs can be taken advantage of by US brokers .

- They allow investors to diversify their portfolio .

Disadvantages of the US deposit slip

Despite its various benefits, ADRs have some inherent limitations:

- They could be subject to double taxation.

- The selection of companies under ADR is relatively limited .

- There are chances of ending up incurring currency conversion fees from an investor’s point of view.

- Most ADRs are not sponsored and, in turn, are often non-compliant with SEC regulations. types of adr