Tax planning vs tax management in tabular form

We explain that what is the difference between tax planning and tax management with table. Taxes are finance charges imposed by the government to finance the public sector and cover other expenses. Countries and economic systems have their own independent tax systems. Failure to pay taxes is a punishable offense.

We explain that what is the difference between tax planning and tax management with table. Taxes are finance charges imposed by the government to finance the public sector and cover other expenses. Countries and economic systems have their own independent tax systems. Failure to pay taxes is a punishable offense.

Individuals and companies must pay the taxes imposed according to the laws of the countries. Additional expenses incurred by individuals and organizations in the form of taxes can be significantly controlled through simple practices. Tax management refers to the practice of maintaining and paying taxes in accordance with laws and requirements.

Tax Management implies effective financial management for tax purposes. Tax planning, on the other hand, is a systematic method of tax aversion. Tax planning enables tax savings by redirecting the tax base towards investments.

The difference between tax planning and tax management is that tax planning is an optional exercise for tax aversion, while tax management is a general term used to describe the practice of timely payment of taxes according to allied standards.

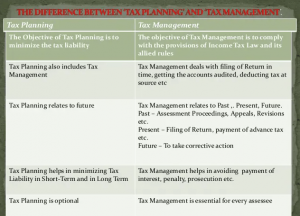

Comparison table between tax planning and tax management (in table form)

Comparison parameter Tax planning Tax management

| objective | Tax planning is done to minimize liability. | Tax management is carried out to function in accordance with the Income Tax Law and related regulations. |

| Relationship | Tax planning includes tax management. | Includes auditing of accounts, filing of tax returns, etc. |

| Hour | it is made for the future. | It can be done for the past, the present and the future. |

| Use | It allows to minimize the tax obligation both in the short and long term. | If done right, penalties and interest can be avoided. |

| Relevance | It is an optional exercise. | Is essential. |

What is tax planning?

Tax planning is an exercise that is carried out to guarantee tax efficiency. Investors often develop a tax plan to optimize their financial situation in a tax efficient manner. It is done in such a way that available resources are used appropriately and efficiently. Proper tax planning helps investors take advantage of tax benefits and exemptions.

Tax planning primarily involves redirecting taxable money to places like retirement plans or other investments, alleviating tax liability. Done right, it can help individuals and organizations save a lot of money. This method basically helps to lock in the amount that would otherwise have been deducted as tax. The blocked amount can be used later in retirement plans.

Tax planning helps streamline returns, adding to people’s overall financial planning. Tax planning is legal and is done in accordance with existing tax regulations. Tax planning has different benefits. Different types of tax planning have different pers. The four main types of tax planning are;

- Short-term planning: planning that is executed at the end of the year to obtain tax benefits.

- Long-term planning: planning that takes place at the beginning of the year and is followed throughout the year.

- Purposeful Tax Planning – Purposeful tax planning is done with a specific goal in mind. This includes selecting the perfect program to maximize profits and profits.

- Permissive tax planning: planning that focuses on the use of permissive laws to obtain maximum exemptions and savings.

What is fiscal management?

Tax management is an exercise that involves the management of personal finances, especially the taxes to be paid. It is a routine procedure that is basically followed by people to ensure timely payment of taxes. The payment of taxes should be made in place of the tax laws and regulations of the economies.

The procedure includes the presentation of declarations and the audit of accounts. The process is holistic, involving transactions in the past, managing current taxes, and planning for the future. Unlike tax planning, it is not a voluntary exercise and is essential for everyone. Failure to administer taxes or failure to file returns can lead to penalties.

The elements of fiscal management are;

- Reduce adjusted gross income: Adjusted gross income is the amount on which one is obligated to pay income tax. A legally reduced amount would automatically reduce the taxes payable.

- Increase the number of tax deductions: Deductions are claims for expenses that can help reduce your tax liability. It is important to know the type of deductions that apply to your annual plan.

- Tax Credit: The tax credit helps reduce the amount of tax to be paid by introducing certain activities that involve such credits.

- Retirement Plans: The easiest way to store income is to plan for people’s retirement in advance. Experienced investors suggest investing at least 5-6 years before your expected retirement date.

The tax filing system becomes particularly complex due to the various tables, fees, and conditions. Each slab has different types of exemptions and associated conditions. Tax planning, if done, becomes part of task management. However, not everyone is involved in tax planning. Tax management allows you to reduce the net amount paid as taxes by filing timely returns, paying taxes in advance, and avoiding penalties by informing the concerned authorities.

Main differences between tax planning and tax management

- Tax planning refers to the practice of planning finances to achieve optimal tax savings, while tax management is the practice of avoiding penalties by timely payment of taxes. Tax planning uses existing provisions to avoid unnecessary taxes.

- Tax planning is about planning and filing tax returns, while tax management is about keeping financial records and taxes.

- The main purpose of tax planning is to reduce the taxes payable to evade the burden on the taxpayer, while tax management is about following income tax rules and making timely payments.

- Tax planning is about reducing tax liability, while tax management is about reducing taxes by filing returns and avoiding penalty payments.

- Tax planning is an optional activity while tax management is mandatory for everyone.

Final Thought

Taxes are mandatory payments that individuals or companies must make to the authorities concerned, generally the government. Tax money is generally reinvested in the public sector for the welfare and development of the people.

It is the duty of all citizens to pay taxes according to the assigned slab rates. Taxes can significantly increase the expenses of a person or organization. There are two ways to handle this situation.

Tax planning is the practice of financial management performed especially to reduce tax liability. This is done by redirecting taxable money to other investments, such as retirement plans. Tax management is the practice of punctual and consistent tax payments. Done right, tax management can also help you save money by filing returns.

It is imperative to understand that the two things are conceptually very different. Tax planning helps you avoid taxes legally. It is about reducing the tax liability of individuals. Tax management, on the other hand, is about maintaining and paying taxes regularly according to allied laws. Based on tax management principles, focus on reducing the net tax amount by taking advantage of the compliance benefits.