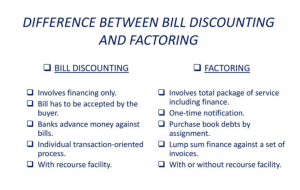

Difference between bill discounting and factoring in tabular form

We explain that what is the difference between bill discounting and factoring with table. Both in the short and long term, companies need funds. If one wants to meet short-term requirements, companies tend to follow the forms of invoice discounting and factoring.

We explain that what is the difference between bill discounting and factoring with table. Both in the short and long term, companies need funds. If one wants to meet short-term requirements, companies tend to follow the forms of invoice discounting and factoring.

In invoice discounting, one can be in full control of your business because you are responsible for managing your sales book. To keep loan costs low, installments are paid and bills are collected.

In invoice factoring, there are value-added services to help a company. It also helps that person’s business collect the amount owed from its business partners, making it easy to pay back your own financed loan.

Invoice Discount vs. Factoring

The difference between invoice discounting and factoring is that while invoice discounting is the amount that the customer pays before the due date at a discount less than the actual rate, factoring means that the customer surrenders his accounting debts. to the financial institution or bank at a discount.

Invoice discounting includes parties such as the payee, the drawee, and the drawer, while factoring involves the customer, the debtor, and the factor.

Bill discounting or bill discounting and factoring help entrepreneurs to use credit in the short term. When an entrepreneur makes a factoring or accounts receivable financing decision, they need to sell the accounts receivable or overdue invoices to factoring.

Comparison table between bill discount and factoring

Comparison invoice discount factoring parameter

| Definition | Invoice discounting is when one delivers the invoice before the due date at a cost less than the actual price. | Factoring is when a company sells its accounting debt to the financial transaction of the factoring company at a discount rate. |

| Part | Commercial debts that carry the part of the accounts receivable. | The totality of the commercial debts of the company. |

| To affect | Advance payment by the customer of the invoice issued. | The full purchase of commercial debts. |

| Kind | In the case of the invoice discount method, only the resource option is available in this case | Both recourse and non-recourse options are available if the business decides to elect to factor all of its share of the business debts. |

| Law and legislation in which the category is included | The banknote discount process is governed by the Negotiable Instruments Act of 1881. | There is no law or statute under which the factoring method is susceptible. |

What is the bill discount?

Simply put, the term invoice discounting means the fee that the bank requires from the seller if it is willing to sell the credit invoices before the credit period deadline arrives.

We will find the frequently used invoice discount method where the letter of credit is made (also commonly written as L / C among the people involved in this field). L / C has become mandatory for import and export these days.

Since the buyer or seller of one country cannot see the seller or buyer of another country. Usually the seller arranges a 1 month, 2 month, 4 month credit window for buyers.

The term “Invoice Discount” is also used for the same invoice discount purpose. The creditworthiness of a buyer should play an important role in determining the amount of discount.

The bank decides the amount of the discount to pay based on the creditworthiness of the buyer. The 3 interested in the process are beneficiary, drawer and drawee.

What is factoring?

Another type of financial transaction is factoring. It is also a component of debtor financing in which the seller of the goods sells all of his accounts receivable to a third party.

The main actors in the section are the customer, the debtor and the factor. Both non-recourse and recourse options are available in it. Although there is no specific act proven by law for this method.

Since the seller is giving up all of the company’s accounts receivable, the financier’s payment is considered in terms of the services provided by him to complete the planned approach.

To meet the cash urgency that exists today, companies often attempt the form of factoring. It allows companies to have cash on hand immediately, although the amount is reduced to the actual accounts receivable.

Another term for factoring is accounts receivable factoring, as the sale of accounts receivable plays a critical role in this. It should be noted that factoring and invoicing do not mean the same in the United States.

In American accounting culture, invoice discounting is commonly understood as the allocation of accounts receivable.

Main differences between invoice discounting and factoring

- In the case of Discounted Debt Invoice, there is no allowance available. But, in the case of Factoring, you can exercise the assignment of Debt.

- In the case of invoice factoring, the source of income of the Financier is only subject to discount charges or in other terms the interests associated with it. But when it comes to factoring, the financier is entitled to receive remuneration for financial services and a commission for other associated services related to the event.

- In invoice discounting, the debt allocation option is not available. But in the case of factoring, the company has the debt allocation option on hand for its purpose.

- The law does not establish certain rules for the factoring method. But in the case of invoice factoring, the Negotiable Instruments Act 1881 is mandated as a guide to finalize the process.

- The two main components of the process are the resource and the non-resource. The resource of the first component has the right to invoice factoring, which means that if the client somehow does not deliver the price of the merchandise in the official term, he does not pay. And then the borrower of the money must pay the amount of money that the particular customer cannot pay. When factoring, resource and non-resource components emerge. The term without recourse means that the borrower is not entitled to pay any money if one or more of his clients are in a situation of not being able to pay. And the buyer of the accounts receivable assumes all responsibility with respect to the purchase and cannot hold the borrower liable for anything other than their financial expectations.

Frequently Asked Questions (FAQ) about discount and invoice factoring

Is factoring a loan?

Factoring is not a loan. In factoring, a company sells its outstanding invoice to a factor. The factor pays them a particular amount that could be 70% to 80% of the amount collected on the invoice.

The rest of the amount is transferred to the company once the customers pay the invoice.

However, the factors charge a fee of around 6 to 8%. Factoring is a method of obtaining early access to money for the current financial needs of the business when the loan is not made. It costs more than a loan, but it is better than having no money.

Is it a good idea to factor the invoices?

Invoice factoring has its pros and cons. It allows you to have early access to cash that can be used to meet the financial requirements of the business today. However, the factors charge a fee of 1 to 5%.

Early access to money carries a small loss, so you need to make sure you can bear the loss or not.

Is Bill discounting a loan?

The invoice discount is a type of loan granted by banks to a borrower. In invoice discounting, the bank takes the invoice from a company or borrower and pays them at the same time.

Subsequently, the bank collects the amount from the borrower’s customer when sending the invoice. However, the bank deducts a certain amount from the bill while paying the borrower.

What are the different types of factoring?

There are many types of factoring.

Here is a list of the main types of factoring:

- Resource factoring

- Advanced factoring

- Bulk factoring

- Bank participation factoring

- Invoice discount

- Complete factoring

- Agency factoring

- National factoring

- Direct export factoring

- Direct import export

- Back-to-back factoring

- Maturity factoring

Is factoring short or long term?

Factoring is a short-term solution for businesses that require early access to cash for fund growth or other financial needs.

Most companies stop factoring after 2 years of incorporation. Due to the factor discounting, a company cannot rely on factoring in the long term, as it would generate more losses than profits.

Final Thought

The main concepts of discount and invoice factoring are the same. Both are invoice financing methods.

The common order of which is the best process comes down to the effectiveness of the credit collection organization, accounts, and bookkeeping debt.

Typically, those with large, established businesses or the collections department choose invoice discounting and those who do not prefer factoring.